During the global COVID-19 pandemic, the automotive industry was certainly among the hardest hit. The relationship between us and our vehicles is continuously evolving. Among the younger generations, disruptive mobility services are a significant influence in changing the way they view and interact with vehicles.

For much of the last century, vehicle ownership was an aspiration shared by many and was a powerful force in shaping the automotive industry. While a very significant share of the market still maintains that aspiration, it’s crucial that the industry grasps that consumer behaviors are changing. Consumers are back to buying cars, but they’re doing it differently.

According to the McKinsey Global COVID-19 Auto & Mobility Consumer Survey, usage of shared mobility services and public transit is picking up significantly. There’s also a substantial increase and interest in purchasing EVs, particularly in Europe and China, motivated by government incentives and increased consciousness about sustainability.

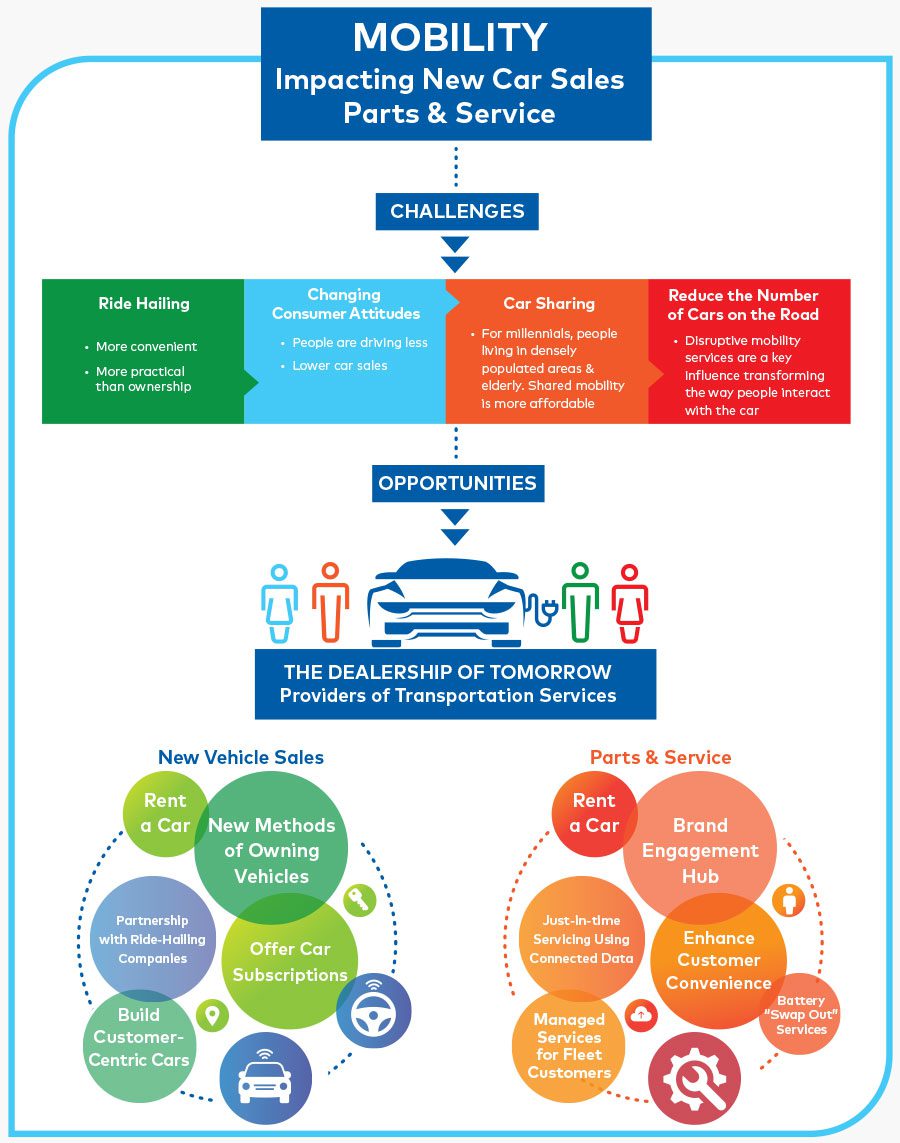

As with connected, electronic, autonomous vehicles and other technological advancements, these new, disruptive forces of mobility are presenting important challenges and also exciting new opportunities for OEMs and dealerships.

The Mobility Generation

The concept of shared mobility has a growing appeal to many market segments. For people living in densely populated areas, Millennials, Gen Z, the elderly and others, shared mobility can be more convenient, affordable and practical than vehicle ownership. Additionally, Fortune Magazine reports that cars sit parked about 95% of the time on average. That is a lot of investment lying idle in parking lots and on driveways.

What does this mean for the automotive industry? Dealership services will take on a new dimension. For OEMs and dealerships to succeed and thrive, they will need to rethink their business models. That means to stop viewing themselves as supplying, selling and maintaining vehicles to the mass market, and reposition themselves as meeting consumers’ need for transportation – in other words, mobility.

“For OEMs and dealerships to succeed and thrive, they will need to rethink their business models.”

Embracing Change, Investing for the Future

According to Fortune Business Insights, the mobility-as-a-service market size is expected to grow to USD 210.44 Billion by 2026. The industry cannot afford to fight ride-hailing and car-sharing services. Instead, they need to embrace shared mobility and use it to their advantage.

While it is almost inevitable that there will be fewer cars on the roads, those cars will be driving more miles in order to give people the mobility they want and need. And that means that OEMs and dealerships need to rethink who they are –

their vision – but also transform their capabilities and how and where they invest in their business.

Dealerships will play a critical role in making it simpler for consumers to use vehicles as much as possible – no matter who owns them. Creating ‘brand engagement’ hubs that join up all areas of an organization will help redefine the dealership business model, allowing them and their customers to take full advantage of this new era of mobility. Key to this is an ability to effectively shift their focus and retrain staff.

“Dealerships will play a critical role in making it simpler for consumers to use vehicles as much as possible – no matter who owns them.”

A Changing Perspective on ‘Car Sales’

Smaller, agile operators have already started employing strategies to a new generation of shoppers. Here are a few ideas on how the automotive industry can adapt and thrive:

- Subscriptions as a purchase option. Instead of committing to a long-term loan with interest, depreciation, and other such constraints, create monthly or annual subscriptions. OEMs and dealerships can use their own vehicles, which they make available to consumers through smartphone apps. Subscriptions give people the ability to pay for a car only when they need or want it. And they can subscribe to different types of vehicles for different uses, such as business, recreation, etc.

- Introduce Transportation-as-a-Service (TaaS) or Cars-as-a-Service (CaaS). Consumers can ‘rent’ or ‘lease’ a vehicle for very short times to meet specific needs on a pay-per-use basis. They just pick up the vehicle from the dealership and pay when they are done.

- Partner with ride-hailing companies such as Uber, Lyft, Didi and others. As more offerings like these emerge, OEMs and dealerships will be provided with increasing opportunities to supply ride-hailing companies with a fleet of local cars, as well as aftersales services such as warranties, parts, service, etc.

- Harness CaaS data insights to build new, customer-centric cars. Connected car data will prove to be a disruptive force across the automotive industry. It will help feed increasing hyper-segmentation, to create cars that address tomorrow’s lifestyle preferences.

“While shared mobility means vehicles will rack up higher mileages, the shift to electric/hybrid vehicles will result in fewer parts to replace and less frequent service requirements.”

Parts & Service in the Mobility Age

Today, parts and service remain the most profitable part of OEM dealership operations. To capitalize on aftersales opportunities in the future, dealerships will need to adapt to new technology and the shift in what consumers of today, and in the future, demand.

While shared mobility means vehicles will rack up higher mileages, the shift to semi-autonomous and electric/hybrid vehicles will result in fewer parts to replace and less frequent service requirements.

Dealerships will also see a rise in fleet customers as they move away from individual vehicle ownership and towards TaaS or CaaS business models.

To succeed in this new era of disruptive forces, companies will need a solid understanding of the new market so they can evolve and innovate in what they offer to consumers. Some examples of new parts and service opportunities include:

- Develop new ways to ‘service’ vehicles. Make the service department the new ‘petrol or gas station’ for electric vehicles, with multiple charging stations.

- Offer a battery swap-out service where technicians will rent and install a fully charged battery to eliminate waiting.

- Offer ‘fleet management services’. Become a B2B asset provider for all parts and service requirements to fleet customers.

- Introduce mobile servicing for customer convenience. Additionally, expand parts and service department hours so the service is convenient and fits around people’s lifestyles more seamlessly.

- Invest in technicians and their skills. Increase pay scales and invest in continuous training and career development. And position them as ‘engineers’,

rather than technicians, to help bolster their reputation and expertise. - Provide help to customers with remote software updates and perform remote diagnostics for autonomous vehicles. Again, this increases customer

confidence that engineers/technicians are experts at diagnosing a car before they even arrive.

The Bottom Line

The truth is, vehicle ownership used to be an aspirational dream, but it simply isn’t the case for everyone anymore. In fact, if anything it is becoming undesirable for many in heavily populated cities, and the presence of disruptive forces means consumers are embracing mobility of a different kind.

This is a challenge for OEMs and dealerships, but it’s an opportunity too. They can use it to their advantage by rethinking their business model – transforming themselves from being sellers and servicers of vehicles, to providers of transportation services. By changing how they think about themselves and how they present that to consumers, they too can enjoy the benefits of future mobility.