Let there be no doubt, automotive retail is undergoing rapid and seismic transformation that will permanently change how OEMs, NSCs and dealers retain profits and engage customers. Drawing upon my years of experience in the technology industry, it’s become evident to me that digital transformation is a certainty and will drastically disrupt how automotive retail businesses are run.

The parts and service segments of dealerships will be among the most profoundly impacted by new technologies and industry trends.

It’s up to OEMs and dealerships on whether they want to surf the technological wave, keep ahead of it or get left behind. Savvy dealerships see opportunity in change and will choose to invest in technology as a pathway to ensure successful aftersales operations into the future.

With the parts and service business supplying over 50% of a dealership’s profit, it’s a no-brainer that investment in technology is where OEMs, NSCs and Dealerships should be spending their time and money to retain their earnings.

Over the past few months, I’ve spent time speaking to some of our valuable OEM partners and Dealerships to discuss both the challenges and benefits of disruption, and how new technology is impacting the way they run their businesses and serve their customers.

What became apparent is that a number of technological trends have emerged. Here’s my take on the five areas that we anticipate will have the most significant impact:

- Evolution of the dealership

- Digitisation of the customer journey

- Connected and more complex cars

- Vehicle ownership structures

- Electric vehicles and autonomous driving

Evolution of the Dealership

Thriving dealerships succeed for a reason – they’re responding to change and evolving. The dealership model is expanding and developing into larger, multi-brand dealerships that exploit the advantages of larger volume, economies of scale and greater processes and system efficiency.

These larger, more successful dealerships around the world are discovering more efficient and integrated software products that are specific to the automotive industry. Technology developers and software providers have realised this and are gathering data from OEMs, dealerships and customer sources to improve demand forecasting, boost productivity, drive better sales processes and create a more personalised customer experience, right across parts and service.

However, there are new challenges on the horizon. With cars becoming more sophisticated and customers seeking new technology, vehicles and components are becoming more complex. The need for more high-tech workshops and skilled technicians is at an all time high. Complicating this further is a skills shortage, with too few new technicians entering the industry – especially in the USA.

As I travel, I see that larger dealerships are placing a greater focus on keeping talent, with faster career pathways and more training. As vehicle technology continues to explode, customers will place greater value in ‘genuine servicing’, making great technicians even more vital. The little local garage around the corner might be in trouble.

Inside larger dealerships (and hopefully yours too), Parts and Service departments work hand-in-hand to boost workplace efficiency and create a good experience for customers. Having both Parts and Service departments accessing the same genuine data from a single source streamlines workflow and removes expenses, such as storing parts and the cost of financing. Shared technology also reduces cycle times for trade customers and gives a more consistent customer experience for retail customers.

Digitization of the Customer Journey

In today’s fast paced and digital world, modern consumers expect new technology, both in their cars and in the parts and service sales process. In this new world, the flexibility of online engagement and self-service are expected by your customers, who enjoy it in all areas of their life.

According to Forbes, by 2025, roughly 75% of the global workforce will be Millennials. They’ve been brought up on a diet of Instagram and Snapchat, so an environment that doesn’t have modern tools, technology and resources is “unimaginable”. Automation, transparency and trust are crucial to retaining Millennial customers for future service and repairs. They want a personalized, digital process and they want to buy on their own terms.

Connected vehicles provide exciting potential to redefine the customer aftersales experience and drive better sales and retention strategies. OEMs and dealerships will have access to more customer and vehicle data than ever before. However, leveraging this data into information that is easily understood and actionable will be challenging.

For example, during a vehicle service, these customers want to feel like a priority at every step of the process – including before, during and after the dealership visit. We are gradually seeing a trend of more targeted individual service and engagement with customers.

For example, during a vehicle service, these customers want to feel like a priority at every step of the process – including before, during and after the dealership visit. We are gradually seeing a trend of more targeted individual service and engagement with customers.

Solutions such as online service bookings, self-serve quoting and electronic vehicle health check systems are playing a key role to improve the customer experience, but there is much more to do.

So, what’s next? How do today’s OEMs and their franchised dealerships continue to grab the attention of customers, improve communications and develop brand loyal vehicle owners?

We are seeing OEMs investing more in data analytics and insights to gather accurate customer information from multiple channels. Detailed and timely evidence that can reveal anything from lapsed service customers to the success of wholesale parts campaigns, as well as valuable insight to determine customer behavior and buying patterns. Information that is rich in detail and allows for more targeted offers across multiple digital channels.

The transformative impact of technology adoption and changing customer expectations now means all departments seamlessly serve the customer. Everyone at the dealership who has contact with a customer is now a salesperson.

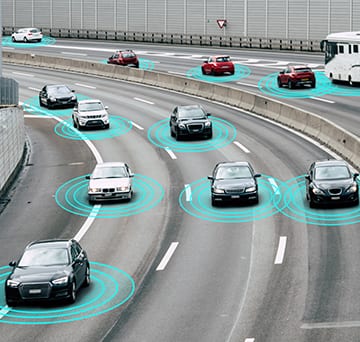

Connected and More Complex Cars

Why the challenge? Well, we see dealerships struggle to fully leverage the data they already have in their back-end systems and the availability of more data will only compound this issue.

Data silos between departments and aftersales software that don’t work seamlessly together are two areas that present an opportunity for improvement. Capturing and converting the connected data into actionable insights will require better cooperation inside the dealership. New technologies will also be needed to normalise disparate data in real-time to empower a timelier, more efficient and customer friendly process.

The benefits of customer friendly processes are evident. When you engage and involve a customer in the service process, they’re more likely to have a positive experience and you’re more likely to retain them as a customer. Better alignment and shared open data integration processes between OEMs, dealerships and technology providers are critical to fully capture the value of connected data, and create positive customer experiences.

The benefits of customer friendly processes are evident. When you engage and involve a customer in the service process, they’re more likely to have a positive experience and you’re more likely to retain them as a customer. Better alignment and shared open data integration processes between OEMs, dealerships and technology providers are critical to fully capture the value of connected data, and create positive customer experiences.

Here at Infomedia, we are excited about the opportunities that lie ahead. Our products are integrating with new vehicle technology that communicates with the workshop and customers – even before customers arrive for their service appointment! Soon, onboard vehicle technologies will help customers plan their service visits using their smart phones and devices. Before customers arrive, they will know exactly what parts are required and when their cars are available to enter and leave the workshop.

Not only that, dealership staff will be able to do more pre-planning, as the detailed information that they receive tells them the faults the vehicle has before it even arrives. Parts departments will be able to use just-in-time (JIT) parts ordering with better inventory control – saving valuable time and money!

Changing Vehicle Ownership Structures

But this is just the beginning. Technology will fundamentally change the way people get from one place to another. Cars-as-a-service (CaaS), ridesharing and car subscriptions are gathering momentum.The basic concept of mass vehicle ownership will no longer be the norm.

Technology changes, along with social and environmental pressures, will also impact the way people drive and what they choose to drive. For example, while travelling in Europe, I noticed the popularity of smaller and smarter vehicles, and that larger vehicles weren’t as common.

Naturally, smaller vehicles are less profitable than larger vehicles. However, consumer electronics – particularly smartphones – have changed consumers’ perceptions. Size doesn’t matter. Consumers no longer believe that smaller is cheaper or less valuable. In fact, they expect smaller cars to be just as smart and technologically advanced as larger cars. Automakers will face a challenge in meeting this shift in perception.

A recent report by McKinsey said: “The automobile, mechanical to its soul, will need to compete in a digital world, and that will demand new expertise and attract new competitors from outside the industry. As value chains shift and data eclipses horsepower, the industry’s basic business model could be transformed. Indeed, the very concept of cars as autonomous freedom machines may shift markedly over the next 50 years.”

Based on our customers’ feedback and our own research, new technology will impact a consumer’s relationship with their vehicle. It’ll change how vehicles are sold, owned, serviced and repaired. IOT (Internet of Things) technology will give real-time data, throughout the value chain, empowering OEMs and dealerships with a better understanding of customer behavior and preferences.

There’s another benefit of this brave new world of data-driven and connected cars. You’ll be happy to know it will lead to more demand for genuine OEM parts. With integrated systems, specialised labour forces and complex safety software, it will be difficult for aftermarket suppliers to replicate proprietary technology used in connected vehicles.

Electric Vehicles and Autonomous Driving

With more electric and autonomous vehicles on the road, dealerships are bracing for impact. But don’t panic, adoption will take time. McKinsey also predicts that by 2030, fully electric and autonomous vehicles will comprise up to 15% of new car sales and 10% penetration in the car parc.

The shift to electric vehicles brings with it a few small problems. Electric vehicles have more electronic components, requiring more specialised servicing than traditional internal combustion engines. Dealerships will need to invest in additional equipment and training. In addition, the cost of maintenance over the first five years of ownership for electric vehicles will be significantly lower than pure combustion engine vehicles leading to a reduction in parts and service revenues. Also, advancements in vehicle manufacturing quality and techniques will result in less frequent service schedules and longer replacement times for parts.

If you’re seeing your customers less often, you better make it count. Customer retention will be even more important. Dealerships will still be “brand experience creators” as customers see more value in taking their new shiny connected vehicle to a dealership for genuine servicing.

Embrace Change: The Key to Evolving & Driving Profitability

If there is one take away as we approach the new frontier in parts and service, it’s that the key to growing the aftersales bottom line is to use new technology that centers around improving the customer experience, both inside and outside of the dealership.

To do this, OEMs and dealerships will need to harness and implement means to capture vehicle and customer insights. They need to adopt new products that draw upon those insights, as a critical path in raising dealership efficiency and improving customer service.

I hope this article shows you that the future is full of opportunities. While there will be inevitable challenges, the benefits are genuinely powerful.

I’ll continue to explore each trend in future editions of Driving Force, providing further insights into how OEMs, NSCs and Dealerships can embrace new technologies to drive parts and service profits and build brand loyalty with delighted customers.